maryland ev tax credit 2020

As a reminder the 6 million funding authorized by the Maryland Clean Cars Act of 2019 HB 1246 as an excise tax credit for both plug-in electric vehicles and fuel cell vehicles for Fiscal Year 2020 July 1 2019 June 30 2020 has been depleted. Mar 28 2019 at 355 pm.

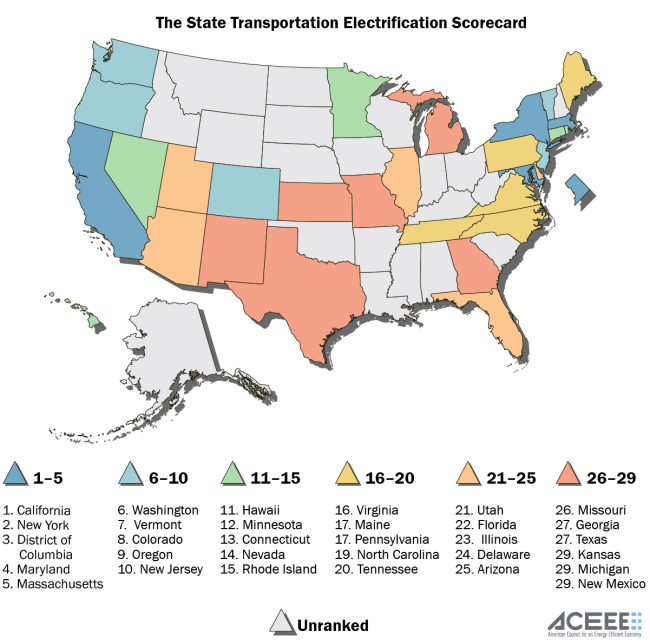

Vermont Ranks Seventh In Nation For Electric Vehicle Policy Vermont Business Magazine

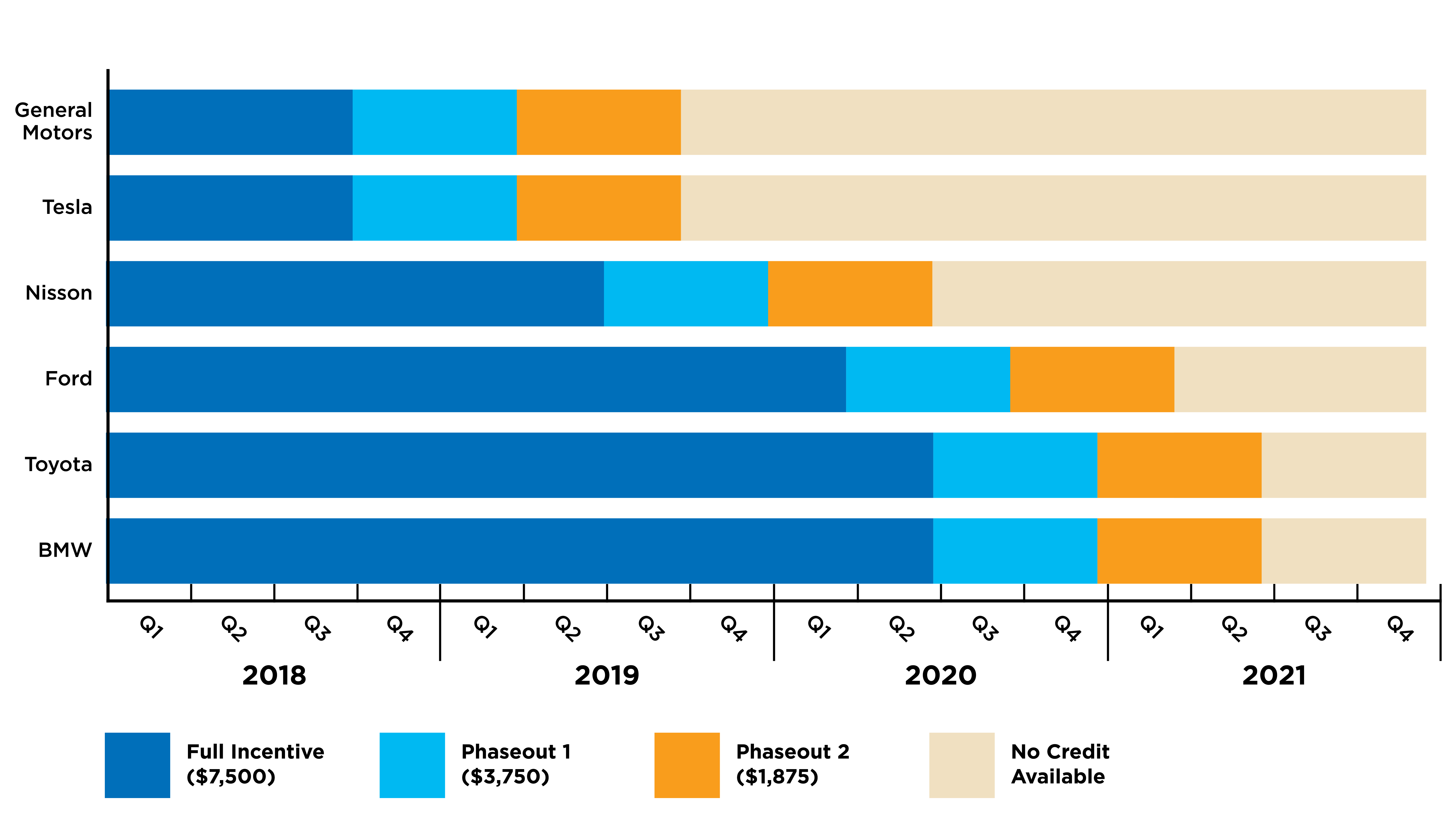

Electric car buyers can receive a federal tax credit worth 2500 to 7500.

. The Maryland earned income tax credit EITC will either reduce or eliminate the amount of the state and local income tax that you owe. January 1 2023 to December 31 2023. Several states and local utilities offer electric vehicle and solar incentives for customers often taking the form of a rebate.

Box 2396 Annapolis Maryland 21404-2396 410-260-7401 1-888-674-0019 MD. Tax credits are capped at 5000 for residential systems and 75000 for commercial systems. Staff will confirm receipt of electronic applications within one to two business days via email.

Effective July 1 2023 through June 30 2027 an individual may be entitled to receive an excise tax credit on a qualifying zero-emission plug-in electric or fuel cell electric vehicle regardless of whether you own or lease the vehicle. The excise tax credit expires. 18 million per FY for rebates for Electric Vehicle Service Equipment EVSE.

The tax credit is calculated as 30 percent of total installed cost of the energy storage system. FY23 EVSE Commercial Rebate Application Form EVSE Form A-Commercial Instructions on How to Fill Out Application Using Adobe Fill and Sign For more general program information contact MEA by email at mikejonesmarylandgov or by phone at 410-537-4071 to speak with Mike Jones MEA Transportation Program Manager. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on the state return equal to 50 of the federal tax credit.

1500 tax credit for each plug-in hybrid electric vehicle purchased Battery capacity must be at least 50 kilowatt-hours Eligible purchase price on plug-in fuel cell vehicles raised from 63000 to 73000. Tax credits depend on the size of the vehicle and the capacity of its battery. Ad Discover The Best EV Charging Station Incentives Rebates 247 Support Easy Paperwork.

Upon purchasing a new EV or PHEV the federal tax credit can be applied to a buyers tax liability for the year and this amount can be up to 7500. 2020 to December 31 2022. Effective July 1 2023 through June 30 2027 an individual may be entitled to receive an excise tax credit on a qualifying zero-emission plug-in electric or fuel cell electric vehicle.

A new Maryland Form MW507 as well as federal Form W-4 For more information about the Maryland EITC visit our Web site at wwwmarylandtaxesgov or call 1-800-MD TAXES I-800-638-2937 or from Central Maryland 410-260-7980. Currently no funding has been authorized beyond the 6 million for Fiscal Year 2020. The Clean Cars Act of 2021 HB 44 proposes to extend and increase the funding for the Maryland electric vehicle excise tax credit.

January 1 2023 to December 31 2023. Marylands National Electric Vehicle Infrastructure NEVI Plan added 542022 Alternative Fuel Vehicle AFV Grants Clean Energy Grants Electric Vehicle EV Charging Station Rebate Program Electric Vehicle EV and Fuel Cell Electric Vehicle FCEV Tax Credit updated 5132022 Solar Canopy Electric Vehicle EV Infrastructure Grant. If you have mailed in your application we ask that you contact us via phone at 410-537-4000 or 1-800-72-ENERGY or email at DLInfo_MEAmarylandgov to confirm receipt.

Grants Loans R ebates Tax Credits Energy Storage Tax Credit Program. The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same. State tax credit equal.

Marylands 3000 excise tax credit on EV vehicles and hybrids is still depleted for the fiscal year but it may be funded again in the future. Explore workplace EV charging incentives. Jahmai Sharp-Moore 443-694-3651 Baltimore MD The Maryland Energy Administration MEA has opened the application period for the Tax Year 2020 TY20 Maryland Energy Storage Income Tax Credit ProgramThis program is designed to encourage the deployment of energy storage systems in the state.

Annapolis Data Center PO. The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids. The tax break is also good for up to 10 company vehicles.

MEA is now accepting applications for the Maryland Energy Storage Income Tax Credit Program for Tax Year 2020. Plug-In Electric Vehicles PEV Excise Tax Credit. Maryland offers individuals who purchase or lease a qualifying plug-in electric vehicle a one-time excise PEV tax credit of up to 3000 while funds last.

Even local businesses get a break if they qualify. 2020 to December 31 2022. Maryland ev tax credit 2020 Wednesday April 27 2022 Edit.

Rebates can be claimed at or after purchase while tax credits are claimed when filing income taxes. The states Motor Vehicle Administration has announced that effective immediately the 6 million funding authorized by the Maryland Clean Cars Act of 2019 HB1246 as an excise tax credit for both. The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles.

0 of the first 8000 of the combined household income. For model year 2021 the credit for some vehicles are as follows. FOR IMMEDIATE RELEASE Contact.

Currently no funding has been authorized beyond the 6 million for Fiscal Year 2020. President Bidens EV tax credit builds on top of the existing federal EV incentive. Maryland offers individuals who purchase or lease a qualifying plug-in electric vehicle a one-time excise PEV tax credit of up to 3000 while funds last.

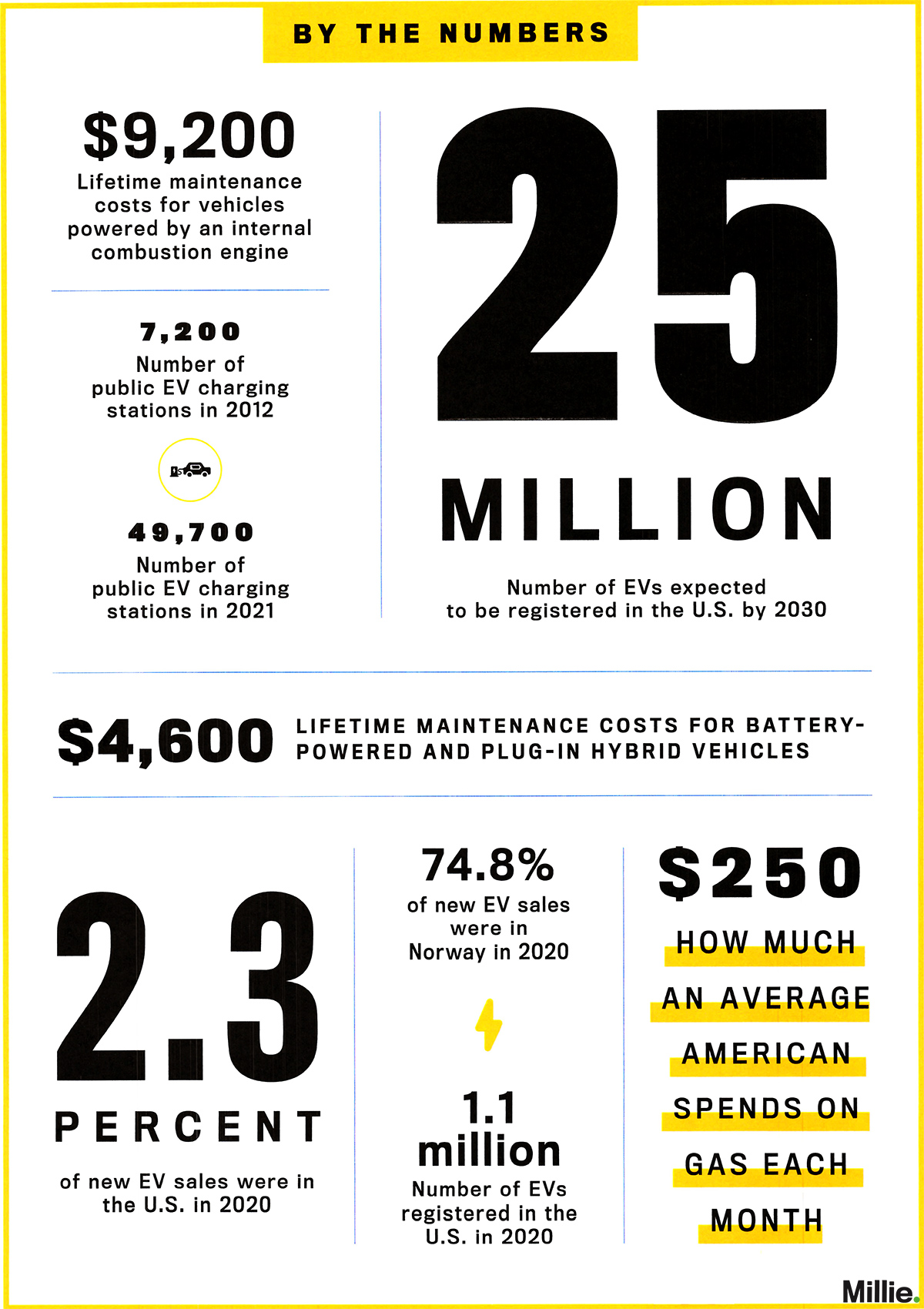

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Ev Charging What You Need To Know About Charging Your Electric Vehicle

Ev Charging What You Need To Know About Charging Your Electric Vehicle

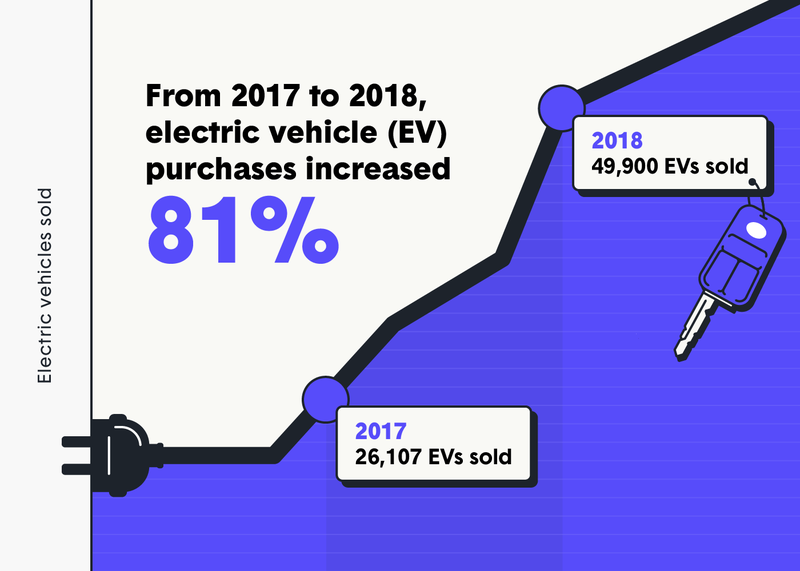

Which Incentives Are Driving Electric Vehicle Adoption

Ev Charger Installation In Montgomery County Md Effortless Electric

Ev Legislative Update Week Of Jan 27 2020 Pluginsites

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Pdf An Analysis Of Attributes Of Electric Vehicle Owners Travel And Purchasing Behavior The Case Of Maryland

Ev Charging What You Need To Know About Charging Your Electric Vehicle

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Ev Charging What You Need To Know About Charging Your Electric Vehicle

Maryland Car Tax Everything You Need To Know

Maryland Clean Cars Act Of 2021 Becomes Law Pluginsites

New Hybrid Electric Hyundai Vehicles For Sale In Lexington Park